Protect your Business today!

Without a backup Payments Solution (like Payminty) you are putting your business at risk. Coupled with the fact Payminty on Stripe has ZERO monthly fees so costs nothing when not in use - its a complete no brainer!

ZERO monthly fees

Business Continuity

Failure Protection

Always on protection that costs nothing when idle.

Build Payminty into your BCP (Business Continuity Plan).

Sometimes payment terminals fail, sometimes your bank has an outage, sometimes your payment processor is down. For a proper BCP you need a solution that is totally separate from your existing payment solution.

We partner with Stripe for our BCP solution for very good reasons including:

-

Complete separation & always on

-

Global redundancy and uptime

-

Cloud based infrastructure

-

Resilience and accessibility

-

Quick, easy, affordable scalability

Powered by:

3%

Most modern payment terminals have a failure rate of 1-3% annually, rising to 5% for portable/wireless models.

11 days

A failure rate of 3% means your Payment Terminal is out of action for 11 days each year, at 5% its 18 days!

$$$

How much revenue would your business lose if you can't take payments for 11 days each year?

If...your mobile payment terminal fails.

Then...grab your phone with the Payminty+ app installed to continue accepting payments. A smart, professional way to keep things moving and your reputation rock solid.

If...your counter top payment terminal fails.

Then...display a Payminty QR Code for customers to scan with their phone. Customers can pay in seconds using Apple Pay, Google Pay or Card. No download or sign up needed, just the Customers own connected device.

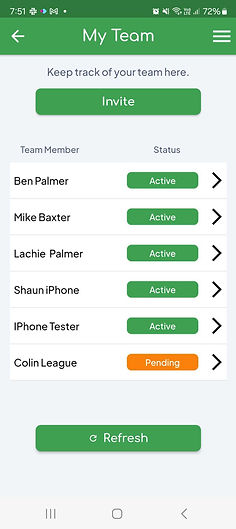

If...your entire network of terminals fails.

Then...rapidly scale your entire team with the Payminty+ app. Invite team members in seconds so they can accept payments on their own phone - all routed to your business account.